Get out of Debt eBook Free Download

We all want more out of life. We want independence, control over our finances, and the ability to make smart financial decisions for ourselves and our families. But with high interest payments that just keep getting higher and higher, it can seem like there is no way out.

The good news is there is a better way! What if we told you there’s a way to become debt free in record time, and build generational wealth at the same time?

A Better Way

The R.O.B.E Approach makes it that simple! With this personalized financial strategy, you can reduce interest payments on your mortgage, credit cards, student loans, car note, and every other kind of loan; organize your income and expenses; eliminate debt in as little as 7-10 years (and that includes your 30 year mortgage); and build wealth by reinvesting those 20+ years of interest savings into more lucrative ventures—and best of all, you don’t have to spend more time or effort than necessary doing it!

This is all done automatically by artificial intelligence (A.I), running all the complex calculations 24/7 for you. All you have to do is follow simple prompts in your Action Plan.

With this personalized approach, you will not only learn how the bank and lenders are taking more of your money in interest payments, but we will give you the tools you need to break free so you can start making smarter financial decisions for yourself and family!

As Seen On

The R.O.B.E Approach

Reduce Interest & Payments

Learn how to cancel interest payments on your loans.

Organize Income & Expenses

Keep track of where your money is

going.

Build Wealth

Convert your Debt to Wealth by reinvesting your interest savings

Eliminate Debt

Become debt-free in as little as 7-10 years! (Including paying off your 30 year mortgage)

Reduce Interest & Payments

Learn how to cancel interest payments on your loans.

Organize Income & Expenses

Keep track of where your money is

going.

Build Wealth

Convert your Debt to Wealth by reinvesting your interest savings

Eliminate Debt

Become debt-free in as little as

5-7 years!

Reduce Interest & Payments

It’s simple: the more interest payments the A.I software can cancel out for you, the sooner you’ll be able to achieve your goals. With the R.O.B.E Approach, you have access to a personalized financial A.I software that unlock daily interest savings for you using the ALOC system. Meaning you pay far less in interest to the bank, and get to keep more of your money!

Organize Income & Expenses

With the tap of a button, the A.I updates your personalized Action Plan and tells you when & where to pay your monthly bills to get the best savings. Keeping track of all your income and expenses under one account, you can now accurately plan and budget for future expenses, making it easier to make smarter financial decisions that will allow you to reach your goals even faster!

Build Wealth

The interest payments the software cancels for you can actually convert your debt to wealth. Meaning, you can now become your own bank and reinvest interest payments the software cancels for you and put them towards building generational wealth.

What would you do with all that extra money? Buy a vacation home, rental properties, a profitable business, or maybe even a franchise—you get to decide.

Eliminate Debt

You now have the ability to pay off debt like your mortgage in as little as 7-10 years instead of giving away all that money to banks and lenders in the form of interest payments for the next 20+ years. As long as you follow the personalized strategy the A.I creates for you in your Action Plan, this approach will help you cancel your interest payments and pay off your debt in a fraction of the time it normally should have taken you. Allowing you to achieve the highest interest and time savings so you can live your best life!

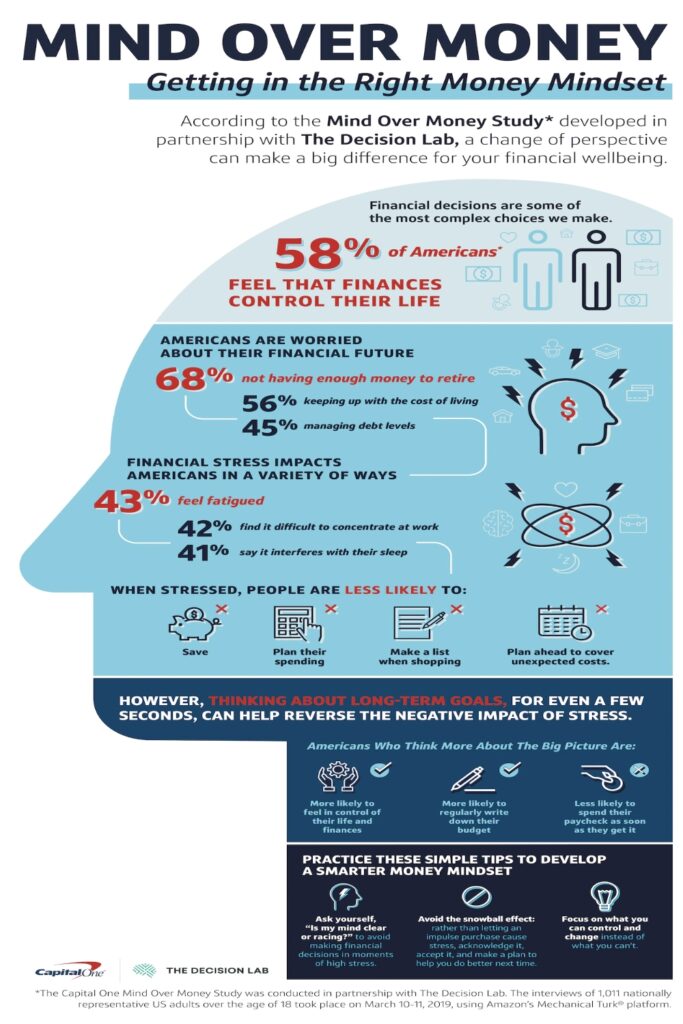

Mind over Money

Most Americans are naked, financially speaking. Only one thing need to go wrong in their finances, and everything starts crumbling down. According to the Mind over Money survey by Capital One and The Decision Lab, 77% of Americans report anxiety about their financial situation. This study also found that, under the effects of stress, Americans are worse at saving and budgeting, feel less in control of their finances, and are more impulsive in how they spend their paychecks. This is 3 out of every 4 Americans that feels naked when it comes to their finances. This is what our R.O.B.E Approach is designed to tackle.

What This Program IS

– This program is for people who want to take back control of their finances and start making smarter financial decisions.

– This program is PROVEN to quickly eliminate debt.

– This program only work if your monthly income exceeds your monthly expense.

– This program is PROVEN to work with or without good credit, AND may even improve your credit.

– This program is PROVEN to free up the funds needed to build wealth.

What This Program IS NOT

– This is NOT Debt Consolidation or a Government sponsored program, and services are not free.

– This is NOT a Bi-weekly Payment Program or Refinance.

– This Does NOT increase your current monthly budget.

– This is NOT a mortgage modification, alteration or any other change to your current mortgage.

– Not everyone qualifies for this program as we can only work with a select few who qualify AND are capable of following their ACTION PLAN.

If you’re like most people, you’re probably paying too much in interest. When you have credit card or other unsecure debt, every day the balances are going up. Some people wait, only to pay out thousands later and have the balance go nowhere. In order to take back control of your finances, you need to start thinking like a bank and know the difference between terms like “interest rate” and “interest volume” (check out question 5 in our FAQ section below to learn more about this).

This knowledge is key to understanding how interest works so you don’t have to keep paying more of it, and start making it work for you instead!

We are very selective about our application process since not everyone qualifies for this program. We want to ensure we are able to help you, and this approach is the right fit for your financial situation. Fill out the form to get your free analysis and one of our agents will reach out to let you know if you qualify, and walk you through the process and next steps.

Important

This is not a government program and this is not free.

What Clients Have to Say ...

Frequently Asked Questions

If the R.O.B.E Approach’s only function was transferring idle money from your bank accounts to pay off your debts, then yes. You could do this yourself.

But there are three things wrong with this idea:

1.R.O.B.E doesn’t just repurpose idle money. It puts the banking power of Wall Street into the hands of the people on Main Street. It’s not debt consolidation, loan forgiveness, biweekly, snowball, or the roll-down method. It’s a mathematically precise system driven by high-level banking strategies that accounts for all your income, expenses, and debt, and tells you which debt to pay off, how much, and when –– to the penny.

2. Income and expenses are not static. The amount of money you bring in and spend fluctuates constantly. Inflation changes, you go on family vacations, your kid needs braces, your car breaks down, life happens. The flow of money, both in and out of your account, is dynamic. Keeping track of all of these changes and adjusting your saving strategy to match would quickly turn into a part-time job, which most people don’t have the time for.

3. Consistency. To shave seven to ten years off your mortgage on your own, you would have to be extremely disciplined about identifying and repurposing those idle dollars in your bank account for a very long time. We’re talking several years.

With the R.O.B.E Approach, you won’t be shaving off seven to ten years. In that time, you can pay off your ENTIRE Mortgage, saving yourself ten to twenty years and tens or even hundreds of thousands of dollars in interest.

It’s the difference between printing out a map and having GPS.

If you take a wrong turn and only have a map to guide you, there’s no way for you to know what your new ETA will be. Plus, your map doesn’t update in real time, so how can you know the quickest route to your destination?

When you make a wrong turn following a GPS, the system updates, telling you exactly how much longer your trip will take and the fastest route to get there.

This is the power of the R.O.B.E Approach.

At any given moment, it tells you the true cost and long-term impact of every financial decision you make, dynamically adjusting to the changes in your income and expenses and telling you the exact date you’ll be debt-free.

Imagine being able to cut ten to twenty years off your mortgage timeline, knowing the month, day, and year when you would finally pay off all your debt. The R.O.B.E Approach gives you that freedom.

We get this question fairly often: How can I pay off my debt so soon without earning ore money or spending a lot less? How does it work?

We all go through those phases where we’re really good about catching little dollars here and there that we can save. But imagine how much different your life would be if you could maintain that level of savings indefinitely.

Using sophisticated banking strategies and algorithms, the R.O.B.E Approach

consistently recognizes those little dollars with mathematical efficiency, every second of every day, for years, until you’re debt-free. It tells you where you can redirect that money, how much to transfer, and when, maximizing the potential of every dollar of your hard-earned money.

Every time you make a purchase, the system recalibrates, updating itself to give you the quickest route to being completely paid off.

R.O.B.E won’t have you spending less, it’ll have you spending smarter. Consistency is the magic of this system, and the rest is math. The result?

Let’s crunch some numbers, shall we?

Let’s say between your twenty-six-year mortgage, car loan, student loans, and credit card debt, you owe the bank $378,122.54 with an interest rate of 3.99%.

Following the bank’s plan, by the time you pay off your mortgage, you’ll have paid an additional $272,172.23 in interest. That’s almost three-quarters of what you owe for your home in interest alone! And when we add that up, it brings your total to $650,294.77.

With the R.O.B.E Approach working for you around the clock, redirecting your idle money for maximum impact, you could save up to $206,421.37.

These six-figure savings would bring your total down to $443,873.40 and leave you debt-free in just seven years instead of twenty-six.

Over nineteen years of your life and two hundred thousand dollars in savings you can now put to work for you and your family.

After you’re fully paid off in seven years, if you put that money into a savings account compounded at 1% over nineteen years, you’d be looking at $1,374,585.29.

The R.O.B.E Approach doesn’t just help you pay off your debt in a fraction of the time. It relieves financial stress, gives you years of your life back, and gives you the power to create wealth.

This is the question we get the most.

Yes, it is good. It is true. And we’ve got the results to prove it. In reality, the system we live in should be too bad to be true. The fact that we’re accustomed to shelling out almost three-quarters of what we owe for our homes to the bank in interest payments is ridiculous.

With your one-time payment, you get lifetime access to the R.O.B.E Approach. This includes everything you see below, for life:

● Updates for the program free of charge.

● Customer service coaching

● Support from your R.O.B.E agent

Our goal is to help you bank like a bank, using the same strategies that have been used against you for decades to pay off your debts in record time.

It’s not magic. It’s math.

Think back to when you were in school. How often did you learn about paying your taxes, how to buy a house or a car, or even just basic money management?

The system barely prepares you for the real world as it is. Unless you pursued a career in finance or a related field, chances are you’ve never heard of anything like the R.O.B.E Approach or the strategies it uses.

And the banks certainly aren’t going to reveal their secrets. Why would they want you to pay less interest? That’s where most of their money comes from!

Banks are in the business of making money, they’re not going to do anything that would jeopardize their cash flow. That’s why banks are always the biggest building in the city.

Ever hear the saying, “Imitation is the sincerest form of flattery?”

That’s what we set out to do with the R.O.B.E Approach. The “Financial GPS” uses the same strategies the banks use, to help you “bank like a bank,” motivating you to pay off your debts in ten years or less.

Unfortunately, not all interest is created equal. Your interest rate may be as low as 3%, but since your interest payments are calculated based on what you owe the bank, the actual amount of interest you pay each month can be as high as 70%.

That means if your mortgage is $2,000 a month, you could be paying up to $1,400 in interest straight to the bank.

This example shows the difference between interest rate and interest volume.

See, back in the day, banks figured out that most people only stay in their newly bought homes for about seven years. So, to rake in as much money as possible, they “front-end loaded” all their mortgages.

Front-end loading means they tack on the majority of the interest to the first seven years of your mortgage, making sure they get their fair share of money in case you decide to leave within that time.

Clever, right?

We designed the R.O.B.E Approach to flip that system on its head and give you the advantage.

By reducing the total amount you owe the bank as quickly as possible, this strategy effectively lowers both your interest rate and interest volume, saving you life-changing amounts of money and helping you pay off your mortgage within or soon after the bank’s front-end loaded seven-year window.

This is actually a misconception.

If we gave you $1 back for every $3 you gave us, how many times would you take that deal?

This is essentially what happens when you leverage your debt for tax purposes. You spend a certain amount of money only to get a fraction of it back.

When you’re leveraging your debt, you want to outperform your interest volume, not your interest rate.

If you have no other choice, tax deductibility can be an advantage to having debt. But you shouldn’t maintain your debt for that benefit alone, it simply doesn’t make fiscal sense.

You could go that route, but would you have the financial reserves to keep living the way you are now? Would you be prepared for any unexpected expenses?

Unless you can pay off all your debt without sacrificing your standard of living, there’s no need to do it all at once. The R.O.B.E Approach can reduce your interest rate down to 1%, helping you reach your financial goals at a more reasonable pace and build even more wealth for you and your family.

That way, you could keep your money for comfort, peace of mind, and emergency funds. And when you’re debt-free, you can put that money to work for you.

Everyone’s financial situation is different, so the cost will vary based on a few different factors: how much debt you have, how much we can save you, and how quickly we can help you pay off your debt.

When you fill out the form, we’ll gather basic information from you, like your interest rate and the total debt you owe, to run an analysis and give you your projected savings and debt-free date.

While we can’t guarantee what the price will be, we can promise that it will be a mere fraction of the amount the R.O.B.E Approach will save you in interest payments.

Plus, with your one-time payment, you’ll have access for life. The savings don’t have to stop when you eliminate the debt you have right now.

So, what do you have to lose? Aside from all that debt and financial stress…

Not at all.

In fact, if you’ve recently refinanced, or tried to and were denied, R.O.B.E is the perfect solution.

Here’s the thing about refinancing:

Yes, it can lower your monthly mortgage payments and ease some financial stress. But only in the short term.

Remember how we talked about front-end loaded mortgages in question 5? In short, the first seven years of your mortgage, you pay a huge percentage of your total interest volume. This is so the banks can collect as much money as possible in the event that you leave your new home within that time.

Refinancing not only extends the length of your mortgage by five to ten extra years, but it also starts you back at square one with front-end loaded interest payments.

All said and done, refinancing will set you back another six to ten thousand dollars.

Money that could be yours going straight to the bank.

Typically, the R.O.B.E Approach costs half or even a third as much as refinancing will cost you in the long run, saves you decades on your mortgage, and tens or hundreds of thousands of dollars in interest.

If you recently tried to refinance but were denied, R.O.B.E is your chance to lower your interest rate to a fraction of what it is now and break free from decades of mortgage payments –– all without refinancing